Understanding Game Investment

Investment opportunities in gaming have surged in recent years, making it an exciting sector for potential investors. This section will highlight current investment trends and key factors to consider when pursuing game investments.

Investment Trends in Gaming

The gaming industry has shown remarkable growth, with global revenues reaching approximately $336 billion in 2021. This growth trajectory is bolstered by various trends, including the rise of web3 gaming, which experienced over 2,000% growth, marking it as the fastest-growing category in the gaming sector. Furthermore, investment in publicly traded video game companies increased by 77% from 2019 to 2020.

| Year | Global Gaming Revenue (in billions) | Web3 Gaming Growth (%) |

|---|---|---|

| 2021 | 336 | 2000 |

Key trends to monitor include the increasing integration of technology, such as virtual reality (VR) and augmented reality (AR), into gaming experiences, as well as the ongoing expansion of the esports sector, which reached $1,384 million in revenue in 2022.

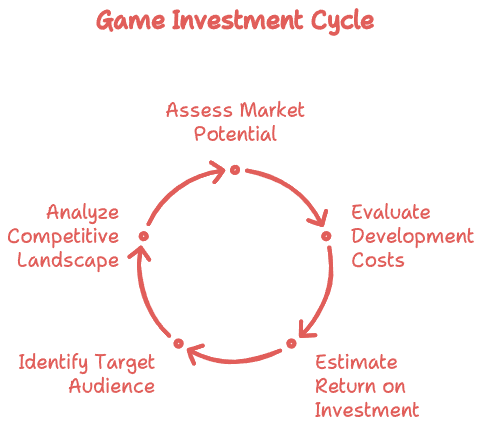

Factors to Consider in Game Investments

When considering game investment opportunities, several important factors should guide your decision-making process:

- Design and Production Quality: High-quality game design and production can significantly affect a game’s success. Look for companies that excel in these areas.

- Intellectual Property (IP) Creation: The ability to generate new IP is crucial. Games with unique characters or storylines often enjoy longer market lifespans.

- Monetization Techniques: Innovative game monetization techniques can enhance revenue streams. Understanding how a game generates income is essential for evaluating its profitability.

- Growth Potential: Assess the long-term growth potential of both the game and the company behind it. The gaming sector is the second-largest media sector and is expected to reach $200 billion soon.

- Market Demographics: The average age of gamers has exceeded 30 years, indicating a mature audience that may have different spending habits compared to younger demographics.

By analyzing these factors, you can identify promising investment opportunities in the gaming industry. For those interested in exploring specific titles and platforms that can help you earn money, check out our articles on top money-making games and best games for making money.

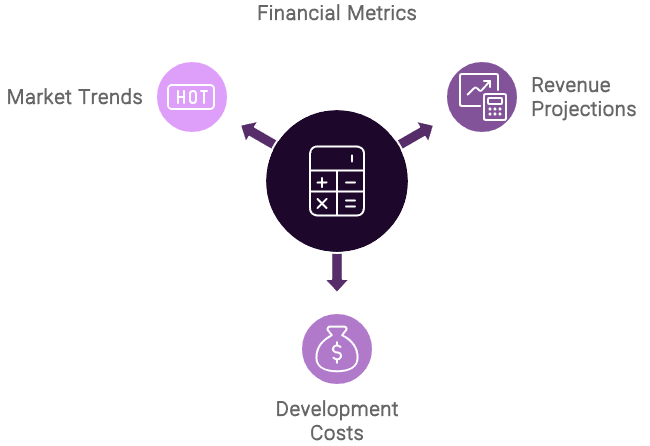

Financial Metrics for Game Investments

Understanding the financial metrics related to game investments is essential for identifying lucrative opportunities. You need to evaluate key metrics and understand the impact of cash flow to make informed decisions.

Key Metrics for Evaluation

When assessing game investment opportunities, there are several key financial metrics to consider. These metrics help you gauge the potential success and profitability of a gaming venture.

| Metric | Description |

|---|---|

| Revenue | Total income generated from game sales, subscriptions, and in-game purchases. |

| EBITDA | Earnings Before Interest, Taxes, Depreciation, and Amortization; a measure of operational profitability. |

| Capex | Capital Expenditures; funds used by the company to acquire or upgrade physical assets. |

| Debt | Total liabilities that the company must repay, impacting cash flow. |

These metrics are crucial for understanding the cash flow potential of the gaming company, especially in private equity investments (Wall Street Oasis).

Impact of Cash Flow in Investments

Cash flow is the most significant factor determining the success or failure of your investment. Without adequate cash flow, other financial metrics become less relevant. Cash flow is essential for several reasons:

- Debt Repayment: Sufficient cash flow is necessary to repay any existing debt and service interest payments.

- Investor Returns: Cash flow provides returns to investors, making it vital for sustaining investment interest.

- Operational Stability: A stable cash flow indicates the company’s ability to operate smoothly and invest in future growth opportunities.

To evaluate cash flow, consider the EBITDA margin, which should ideally show a stable upward trend rather than volatility. Additionally, assess the leverage ratio, which compares the company’s debt levels to industry standards. High existing debt can limit cash flow available for new investors (Wall Street Oasis).

While Return on Investment (ROI) is important, cash flow takes precedence in private equity investments (Wall Street Oasis). By focusing on these financial metrics, you can make more informed decisions about your game investment opportunities. For insights on specific games, check our articles on the top money-making games and the best games for making money.

Emerging Opportunities in Gaming

As the gaming industry continues to expand, new and lucrative investment opportunities are emerging. Understanding these growth areas can help you make informed decisions and capitalize on the potential for profit.

Growth Areas in the Gaming Industry

Several key sectors within the gaming industry are experiencing significant growth. Here are some noteworthy trends:

| Growth Area | Description | Current Value (2021) |

|---|---|---|

| Global Gaming Industry | Reached a staggering $336 billion, driven by increased demand for interactive entertainment. | $336 billion |

| Web3 Gaming | Fastest-growing category, with growth exceeding 2,000% as blockchain technology gains traction. | Not specified |

| Esports | Revenue growth with an average annual increase of over 30% until 2018; reached $1,384 million in 2022. | $1,384 million |

| Virtual Economy in Gaming | Expanding as players engage in digital asset trading, driving new monetization techniques. | Not specified |

The gaming sector is now the second largest media sector, poised to reach $200 billion. The average player age exceeds 30, indicating a mature audience eager for new experiences.

Potential Investment Opportunities

Identifying potential investment opportunities is crucial for maximizing returns. Here are some areas to consider:

- Publicly Traded Gaming Companies: Investment in publicly traded video game companies reached a new high in 2020, up 77% from 2019 (Selborne Consulting). This trend indicates strong investor confidence in the industry’s future.

- Esports Ventures: With esports revenues growing significantly, especially in markets like China, investing in esports teams or tournament organizers can yield substantial returns (Influencer Marketing Hub).

- Web3 Gaming and Blockchain Projects: The rise of web3 gaming presents a unique opportunity to engage in decentralized finance and virtual economies. This category’s rapid growth can lead to profitable ventures in digital asset trading and game monetization techniques (virtual economy in gaming).

- Game Monetization Techniques: Exploring innovative game monetization techniques can enhance revenue streams for new games. As developers seek to maximize earnings, understanding these methods is vital for investors.

- Top Money-Making Games: Investing in the top money-making games can provide insights into successful titles that attract players and generate revenue.

As the gaming industry evolves, staying informed about these growth areas and investment opportunities can position you for success in 2024 and beyond.

Esports Investment Landscape

Growth of Esports Industry

The esports industry has seen remarkable growth in recent years. In 2022, esports revenue reached $1.384 billion, reflecting a year-on-year growth of 16.4%. This upward trend is expected to continue, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately 8.0% for esports enthusiasts by 2025. The total esports audience is predicted to reach 640.8 million, comprising 322.7 million occasional viewers and 318.1 million enthusiasts (Influencer Marketing Hub).

Esports tournaments have evolved significantly, transitioning from local arcades to large arenas, with total prize money awarded in tournaments amounting to $1.614 billion. The average tournament prize pool has also seen a rise, from approximately $42,250 in 2019 to around $44,971 in 2022. This growth in prize money highlights the increasing stakes in competitive gaming.

| Year | Total Prize Money | Average Tournament Prize Pool |

|---|---|---|

| 2019 | $236,221,114 | $42,250 |

| 2022 | $237,760,587 | $44,971 |

Investment Considerations in Esports

When considering investment opportunities in the esports sector, several factors should be taken into account. The increasing viewership and revenue growth create an enticing environment for potential investors. However, it is crucial to evaluate the following aspects:

- Market Trends: Stay updated on the latest trends in the gaming industry. The popularity of specific games can fluctuate, impacting revenue and audience engagement.

- Team Performance: The success of esports teams can significantly influence investment potential. High-performing teams tend to attract sponsorships and have larger fan bases, which translates to higher earnings.

- Sponsorship and Advertising: As the esports audience grows, so does the interest from brands looking to engage with this demographic. Understanding the dynamics of sponsorship and advertising in esports can provide insight into revenue streams.

- Player Contracts and Talent Development: The commitment of esports athletes is intense, with many spending 70-80 hours per week training. Investing in talent development and securing contracts with skilled players can yield substantial returns.

- Virtual Economy: The integration of virtual economies in gaming can create additional revenue opportunities through game monetization techniques and in-game purchases.

Before diving into the esports investment landscape, consider exploring the top money-making games and the best games for making money to identify potential lucrative ventures. Understanding these elements will position you better in the rapidly evolving world of esports investments.